For freelancers in the UK, securing a loan can sometimes feel like an uphill battle. Unlike traditional employees with a steady paycheck, self-employed individuals must navigate the unique challenge of proving their earnings. Whether you’re looking to finance a new project or consolidate existing debt, understanding how to present your income accurately is crucial. This blog post delves into the nuances of acquiring personal credit for freelancers, offering essential insights and advice.

Freelancers may face more scrutiny when applying for loans due to the unpredictable nature of their income. Lenders typically prefer the reliability of a full-time salary, but there are ways to demonstrate financial stability effectively. This guide will explore the strategies freelancers can use to enhance their creditworthiness and gain access to the financial support they need.

Understanding the loan application process for freelancers

The loan approval process often seems daunting, especially if your income varies from month to month. Lenders assess risk, and a freelance profession can signal uncertainty. However, by implementing the right strategies, you can make yourself a more attractive candidate. Documenting your financial history and maintaining good credit standing are key steps.

When approaching lenders, it’s essential to have comprehensive records of your freelance work, including contracts and invoices. Consistent documentation of earnings over time will help in painting a clear picture of your financial situation. Be prepared to show detailed accounts, often spanning over two or three years.

Preparing to prove your income

Proof of income is a crucial component of any loan application for freelancers. Tax returns, bank statements, and financial accounts are primary documents you’ll need. Ensure they reflect a stable income, highlighting any patterns of growth or consistency. If your earnings are seasonal or fluctuate significantly, clearly indicate these trends to the lender.

Additionally, compiling a portfolio of your work along with testimonials from clients can strengthen your application. This further verifies your professional reliability and the continuity of your work. Presenting a cohesive and transparent financial history increases lenders’ confidence in your ability to repay borrowed funds.

Navigating self-employed finance options

Freelancers often have access to unique financial products designed specifically for self-employed individuals. These options might include specialized personal loans with terms that cater to variable income streams. Exploring such facilities can yield favorable conditions that align with your freelance lifestyle.

Moreover, some lenders offer loans that take into account future potential earnings, helping you avoid the pitfalls of irregular income. Building a strong relationship with a financial advisor can offer personalized guidance in choosing the most suitable credit solution for your business and lifestyle needs.

Practical steps to boost your creditworthiness

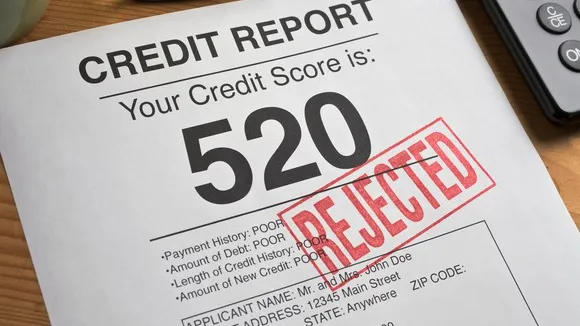

Boosting creditworthiness begins with understanding your credit score and improving it if necessary. Timely payment of bills, reducing outstanding debts, and limiting hard inquiries can enhance your credit profile. Freelancers should also consider setting up a regular income system, showing funds coming in at predictable intervals.

Additionally, offering collateral can make lenders more willing to approve your loan application. This may include property or other assets. Securing a loan as a freelancer requires demonstrating financial responsibility, which can be achieved through consistent financial management practices and presenting a professional image to lenders.

Final thoughts on securing credit as a freelancer

While obtaining a loan as a freelancer in the UK poses its challenges, it is not an impossible task. By meticulously managing your financial affairs and presenting a solid case to lenders, you increase your chances of receiving favorable terms on personal credit. Remember, the key lies in demonstrating income stability and financial responsibility.

Understanding the intricacies of the application process and proactively preparing your documents will simplify the endeavor significantly. Whether you’re seeking funds to expand your freelance business or to manage personal expenses, the right approach can open doors. Stay informed and proactive in your financial planning, and the benefits will follow.