Student loans play a pivotal role in enabling students across the UK to access higher education. As 2025 approaches, there are crucial changes on the horizon that borrowers need to be aware of. Whether you’re planning to start university soon or are already repaying, understanding these upcoming adjustments can significantly impact your financial planning.

Preparing for these changes is essential to ensure you’re in the best financial position possible. Let’s delve into what these modifications mean for you and how best to adapt to them, keeping both your educational and financial goals in mind.

Upcoming changes in 2025

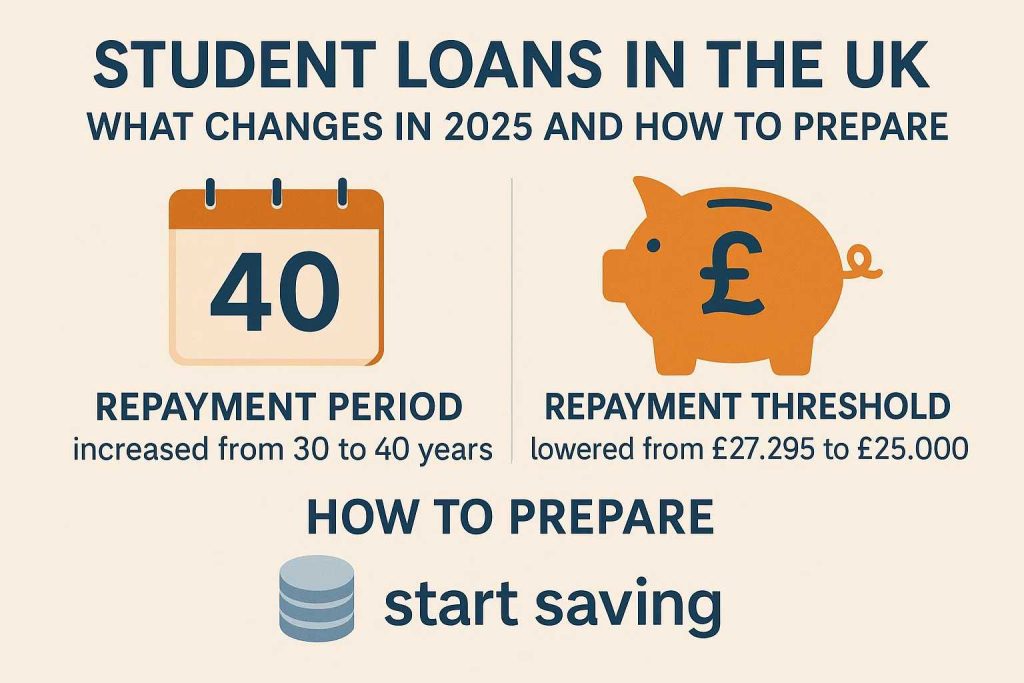

The student loan framework in the UK is set to experience notable changes in 2025. These adjustments affect both new borrowers and those currently repaying their loans. The government aims to improve the financial sustainability of the student loan system while also addressing concerns around repayment terms and thresholds.

One significant change involves the repayment threshold, which is the income level at which repayments begin. Additionally, the interest rates applied to outstanding loans may see an adjustment. These changes are intended to make the system fairer and more manageable for graduates but will require careful planning by current and prospective students.

Impact on current and future students

The changes in the student loan system will directly impact both current students and those considering their higher education options. For current students, understanding how these changes will alter their repayment schedule is vital. Future students will need to factor these adjustments into their financial planning and decision-making process.

Graduates may find the extended repayment periods beneficial, as payments may become more manageable over time. Nonetheless, it’s critical for all borrowers to assess their budgets and financial commitments to ensure that they are prepared for these changes.

Strategies for preparing for 2025

To best prepare for the upcoming modifications to the student loan system, a proactive approach is essential. Start by reviewing your current financial situation, including income and expenses, and consider how the alterations could impact your finances. Keeping abreast of updates and new guidelines issued by the government is crucial.

Additionally, utilize tools and resources available specifically for managing student debt. Engaging with financial advisors or services can provide a personalized approach to dealing with any uncertainties regarding loans, helping you stay ahead of the curve.

Practical steps to mitigate impact

First, stay informed by regularly checking official resources and announcements. Understanding every detail of the changes will allow you to plan effectively. Consider setting aside a portion of your income to build a buffer that will ease any increased financial burden when the changes take effect.

Also, consider alternative funding options, such as scholarships or part-time work, which can minimize reliance on loans. Adjust your budget to cut unnecessary expenses, focusing more on savings and debt management strategies. These practical steps can help you mitigate the potential impact of 2025 changes.

Conclusion

As 2025 approaches, navigating student loan changes in the UK can seem daunting. By understanding the alterations and strategically planning for them, you can position yourself advantageously. Whether you’re a current student, recent graduate, or prospective borrower, staying informed and taking proactive steps will be key to managing this transition smoothly.